14 Tips to Prepare Your eCommerce Store for the Holiday Season

GST or the Goods and Services Tax is a value-added tax applied on goods and services sold for domestic consumption. A unified GST system can now be seen in many countries.

While France was the first country to implement GST, as many as 160 countries followed their path in one form or another. India was one of the last countries that announced GST in 2017.

Ways of selling goods and services have drastically changed over the years, as online is now the preferred option over the physical way.

So, naturally setting up GST on an eCommerce website is one of the important aspects of building one.

As more and more countries adopting the GST system, we are getting many queries on how to set up GST on Dokan and WooCommerce so that they can calculate and show GST right at the customer invoice. Because unless they can calculate and cut taxes on the sale, they’ll have to incur losses.

So we decided to dig deep and show the ways to configure GST on the sales invoice. We come up with pretty interesting ideas, and this blog will show you the easiest one from those.

What is GST All About?

You might already have a basic understanding of GST from the paragraph above. But let us clear your ideas a little bit more.

GST, also known as Goods and Services Tax is included in the final price and the end customers have to bear this. The seller then passes the tax amount to the government.

Usually, GST works as a common tax across the nation. So it reduces the complication. That’s why many countries around the world are opting for this taxation method.

However, as an online business also have to abide by the government rules and regulations, you need to implement the GST taxation system on your eCommerce site as well.

How to Configure GST for Sales Invoices in WooCommerce – Step by Step

Configuring GST for the sales invoice is actually very simple and straightforward. You can implement this just like any other taxation in WooCommerce, with a slight bit of modification. Until a dedicated option or plugin is developed for GST, this way will work just fine for your eCommerce site!

Pre Requisites to Implement GST

In order to configure GST on your eCommerce site using our method, you will have to ensure the following things –

- Working WordPress site.

- WooCommerce for enabling eCommerce options.

- Dokan. (If you need a multi-vendor marketplace.)

After ensuring all of the above, it’s time to configure GST on your sales invoice. Don’t worry, it’s easy as a pie!

How to Create Website Contents That Convert Leads Into Customers

Setting up GST on WooCommerce

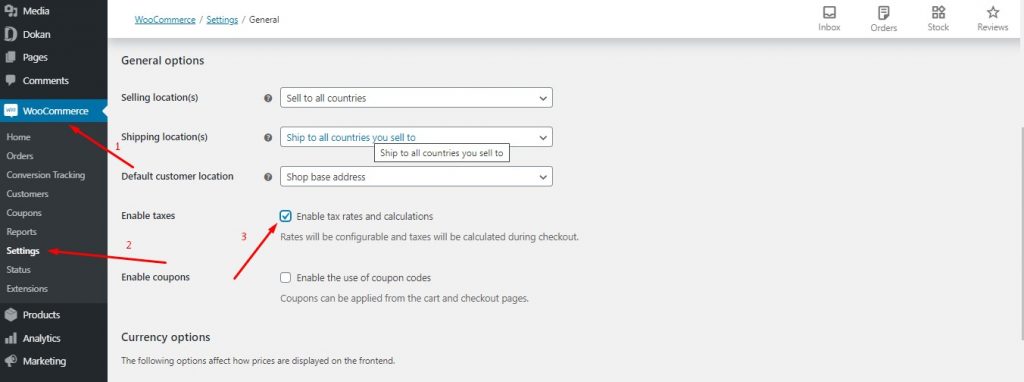

First login to your WordPress powered website. From the WP Admin Dashboard, go to WooCommerce > Settings > General. Now scroll down and check on Enable tax rates and calculations.

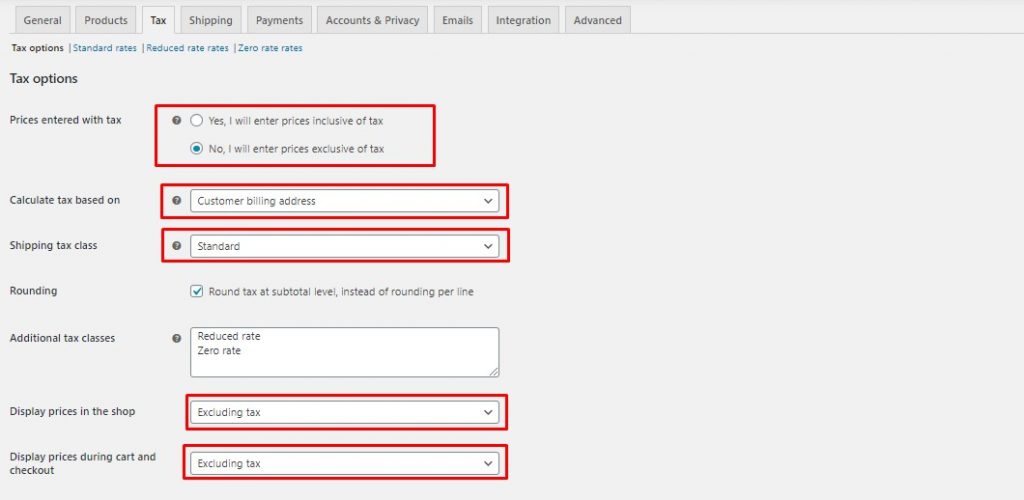

Once you do that, you’ll find a tab called Tax alongside others inside the WooCommerce settings. Now altered the settings just like the image below.

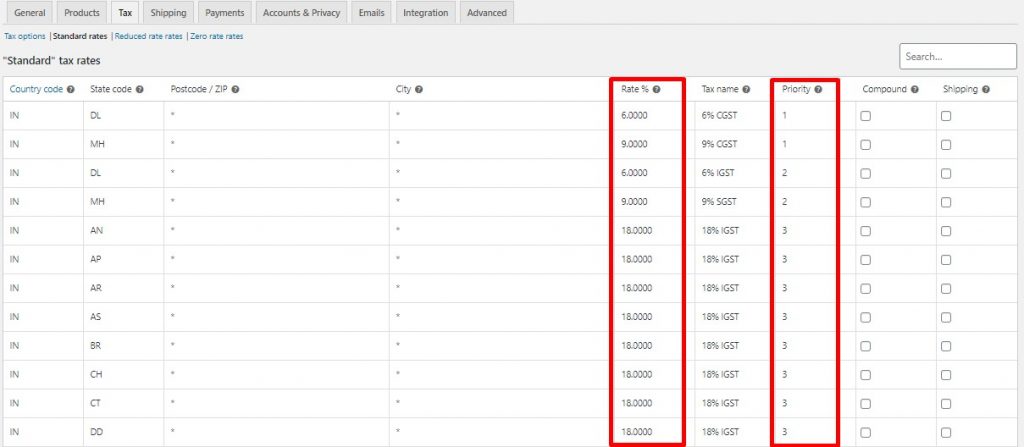

Now click on the Standard rates which you can find on the same page. Here you can find an Import CSV option. Click on that and upload the following file.

GST Tax RateDownload

Please note that this CSV file contains all the Indian state codes and the tax rates while considering Maharashtra as the shop location while considering apparel as the product. It contains CGST, SGST, and IGST columns as per state. We categorized the tax percentage by setting a priority.

If you are in any other state or country, selling any other product, make sure to modify the Tax Rate and Priority as per your requirement.

Yes, you have successfully implemented GST on your website.

How it Turns Out

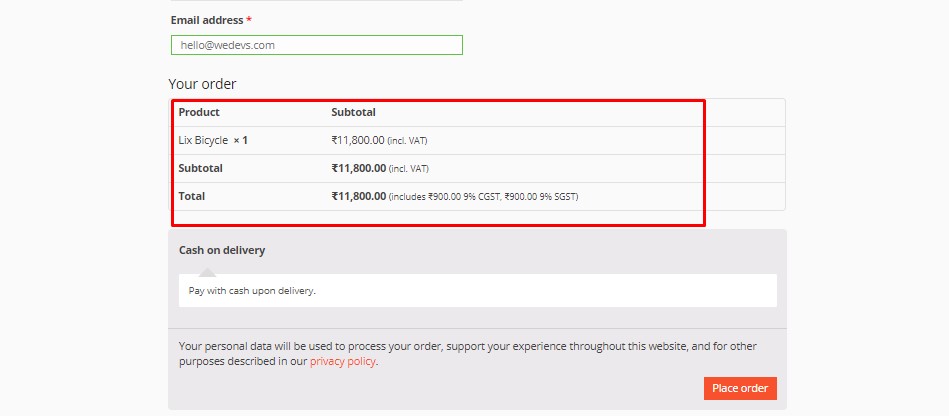

We tried ordering a product from our website after setting the tax rates. And it worked like a charm. Want to see our tax rate in action? Here you go!

As you can see the price is showing inclusive of VAT. The original product was ₹10,000. An additional ₹900.00 or 9% CGST, ₹and 900.00, or 9% SGST was included over that price.

Setting up GST on your Dokan Powered Multivendor Marketplace

See how easy it was to set up GST on your WooCommerce-based site? Now if you have a Dokan-powered multi-vendor marketplace, you might have a question hovering over your mind. “Can I implement GST on my multivendor marketplace as well?”

Well, WooCommerce powers the Dokan multi-vendor plugin. So any settings you that you modify on WooCommerce will also have an impact on the Dokan. So you don’t actually have to configure the settings for Dokan.

Our existing settings will be in action even on a multi-vendor website. Below is an example of that.

Make WooCommerce GST Effortless & Easy

Like any other technology, eCommerce is always evolving. And rules and regulations are also being imposed on online business, just like an offline business. So we need to adapt to those regulations by implementing those on our websites.

GST is one of the most widely implemented tax regulations and it is important that we set it up on our website to avoid incurring losses. And if you use WooCommerce for your eCommerce site, it actually becomes super easy to implement GST, as you can see from the article.

How to Find and Convince Vendors for Your Multivendor Marketplace